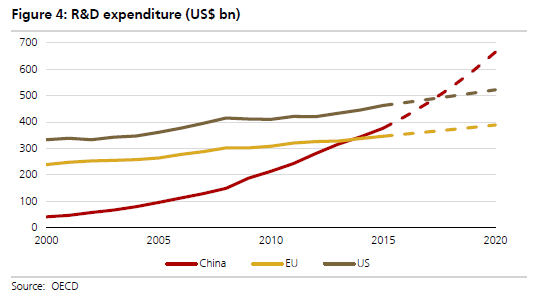

China may spend more on R&D (in PPP terms) than the US very soon. Innovation in China might shift the debate away from concerns about over-investment towards new growth areas.

China may spend more on R&D (in PPP terms) than the US very soon. Innovation in China might shift the debate away from concerns about over-investment towards new growth areas.

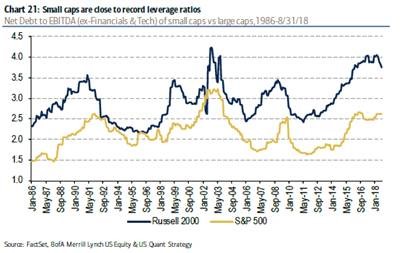

Warren Buffett on small cap value stocks:

“You have to turn over a lot of rocks to find those little anomalies. You have to find the companies that are off the map – way off the map. You may find local companies that have nothing wrong with them at all. A company that I found, Western Insurance Securities, was trading for $3/share when it was earning $20/share! I tried to buy up as much of it as possible. No one will tell you about these businesses. You have to find them.”

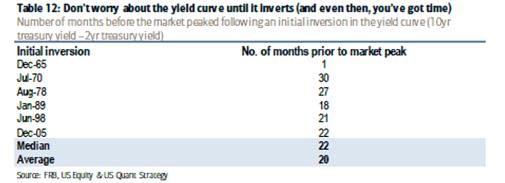

Is it possible to predict recessions? Maybe!

This post comes just right having observed a strong flattening of the Treasury yield-curve over the past weeks. Market participants are wondering whether this is a recession signal (historically, yield-curve inversion was the best predictor of recessions). However, there are some doubts about the reliability of the yield-curve signal for recessions given the depressed term-premium caused by global QE.

From a top-down perspective, should you allocate to (or overweight) emerging market (EM) or developed market (DM) equities? What drives the relative performance of these markets?

Typical country rotation models rely on ranking of certain risk premia and go long/short the top/bottom countries. However, we shall take a different approach here. We will first have a look and identify what explains the relative performance of these two markets from a fundamental point of view and then go on and develop a tactical trading model (long-short).

Should you be holding longer- or shorter-term Bonds? As we know, this depends mainly on factors such as inflation and the level of economic activity in the case of developed markets government bonds as default risk is usually very low. Central banks will raise the benchmark interest rate if inflation is at target (usually 2% in developed economies) and economic growth is sound. Since central banks control short-term interest rates, shorter maturity bond prices will fall if policy rates increase. What happens to long-term interest rates? Long rates are influences mainly by supply and demand dynamics of the bond market. If the market thinks that inflation will rise, future cash flows will be worth less and investors will demand a higher premium to compensate for the loss in purchasing power so that long-term interest rates will rise too. Hence, monetary policy and markets’ inflation expectations will tell us which part on the yield-curve is most compelling at any point in time. Needless to say, monetary policy does not change month over month. However, interest rates can move substantially within a short period of time as we can see below for various 10-year interest rates.